Categories

Last-mile insurance & safety compliance

As deliveries boom in an increasingly more remote and digital world, last-mile delivery is more critical than ever. Retailers depend upon last-mile truckers to ensure on-time deliveries.

With more growth opportunities than ever before in the supply chain industry, fleets are looking to expand by adding qualified drivers and fleet technology to improve efficiency and lower their risk. Are you ready for the risks of this high-pressure and expensive part of the supply chain?

What are the safety requirements for FMCSA compliance?

In the last mile space, box trucks, step vans, and cargo vans are categorized as motor carriers and must follow FMCSA rules and the road rules in their area. As more new drivers enter the space, adequate training is a must, even if their vehicle does not require a commercial driver’s license. Studies show that more than 50% of accidents happen due to cell phone use while driving. Companies must make sure the technology they use for logistics, routing, and efficiency is not jeopardizing the safety of their drivers and the public.

Furthermore, the FMCSA states, the average fleet vehicle accident costs a company $22,000, with injuries, the average rises to $331,000. In the event of a fatality, it can cost $7.2M! These accident-related losses are one of the leading causes of small business failures in the US. What is so frustrating about such statistics is that some or most of these catastrophes are preventable.

The good news is that telematics is here to help. Fleet Management use is increasing, with 86% of fleets now using telematics, up from 48% two years ago, leading to a rapid decrease in safety incidents.

Assess your accident risk!

Accident Risk Calculator

Accident Risk Calculator

Companies that implement an operational program such as telematics or fleet tracking that monitors driving habits play a significant role in safety compliance. When implementing this technology, it is essential to document best practices, outline your company’s driving requirements and safety standards, and include your cell phone policy. This article is not an exhaustive or complete list of safety requirements; we always recommend seeking the expertise of a safety partner or insurance agency that specializes in transportation compliance.

How can Telematics help with safety?

Eliminate unsafe driving & unauthorized vehicle use

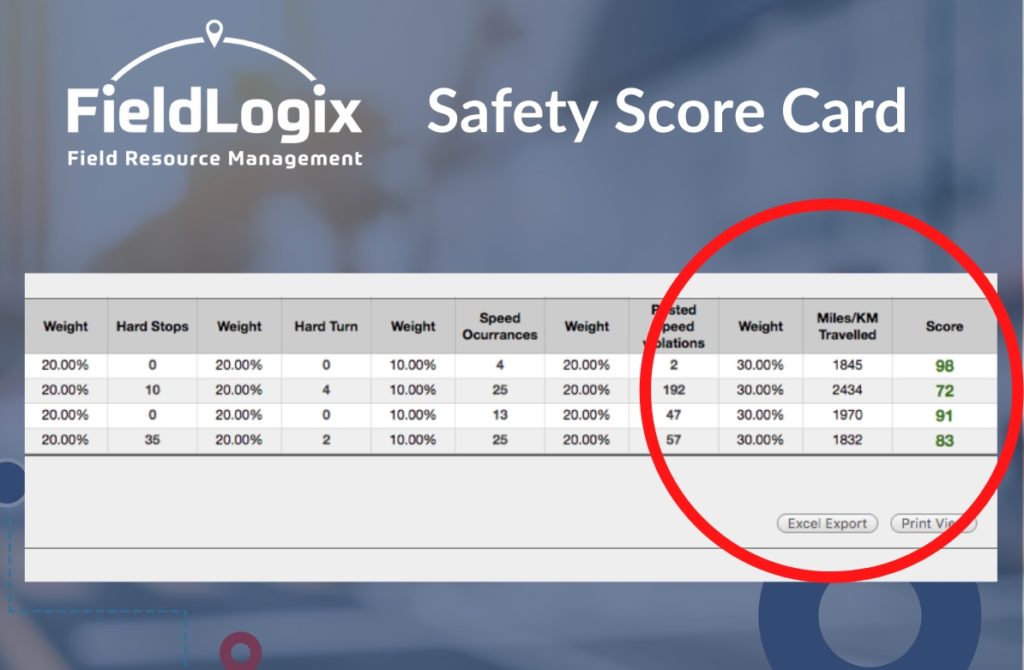

Apply weights to each type of driver behavior, such as aggressive driving events, speeding occurrences, and posted speed violations. We then rank your drivers on a scale of 1 to 100 so you can quickly determine who your top performers and bottom performers are so that you can reward or coach your drivers accordingly.

Ensure your fleet vehicles are not being used after work hours or for personal use. Vehicles used outside of the scope of your company insurance policy can significantly increase the odds of a safety incident and liability.

Many insurance companies recognize the safety benefits of our technology, and in fact, they often reduce insurance premiums by 10% to 15% when using a fleet management system. Be sure to check with your agent to find out more.

What is last-mile insurance, and why is it beneficial for truck drivers?

Most people, including truck drivers, find paperwork tedious. However, having correctly filed paperwork is non-negotiable. If this step is missed, insurance claims are denied in case of an accident, and trucking companies are legally punished for negligence. This requires solid communication with your insurance broker and insurance carrier.

Drivers should focus on driving, and many fleet operators suffer from prioritizing their day-to-day operations over ensuring safety compliance. The benefit of hiring an insurance agent as a partner is to help you effectively manage the risk of being in business while you focus on completing your routes. Drivers are frequently stopped and checked due to the cargo size they carry and thus are subjected to compliance scrutiny. The benefit of insurance is the coverage and the value of safety auditing and risk management. You and your drivers are prevented from making oversights or mistakes that can be costly and legally complicated in the future.

Chris Mahlberg has been helping the transportation industry with insurance solutions since 2011. He started helping difficult fleets like home delivery services (furniture/appliance), non-emergency medical transport and now helps courier service fleets and over-the-road trucks. His company S.W.A.N. Insurance (Sleep Well At Night), focuses on helping new and experienced business owners navigate the transportation insurance landscape. He achieved the Transportation Risk Specialist (TRS) designation in 2021. While located in San Diego, CA, he is licensed in many states and can help clients nationwide. You can reach Chris at phone: 858-381-3108, chrism@swan-ins.com.

SWAN Insurance insures you so that you can sleep well at night. We provide our clients relief by providing them with the insurance they need in high-risk industries, including last-mile transportation. If you have questions about your Motor Carrier Authority or the correct type of coverage for you, give us a call, and one of our insurance specialists can provide you a quote today.