Big Savings on Equipment

Save big for your equipment purchases under section 179 in 2025! Thanks to the One Big Beautiful Bill, the IRS is granting the most generous tax deduction in decades for equipment purchases! You can reduce your taxes by depreciating a majority of your equipment purchase costs in the current tax year. To make the program even better, the deduction can be applied to cash purchases as well as purchases under our $0 upfront cost Service Term program. This is a great opportunity to receive significant tax savings if you plan on purchasing GPS tracking devices or dash cameras in 2025.

Calculate your potential savings here

You’ll have to move quickly to qualify for the deduction because the equipment must be purchased and placed in service by December 31, 2025.

The Section 179 tax deduction can be applied to the following equipment:

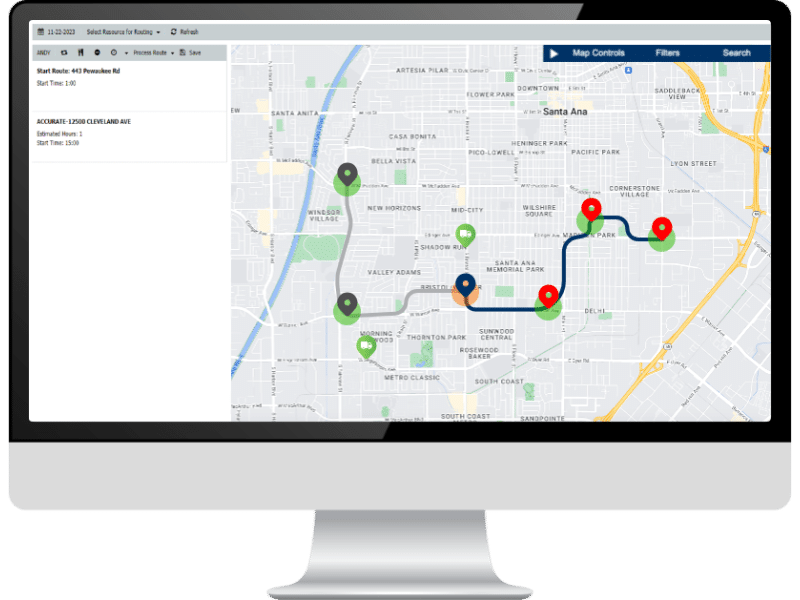

GPS Fleet Tracking

Purchase GPS fleet tracking devices to improve driver safety, productivity, and vehicle health.

Dash Cameras

Purchase dash cameras to avoid fraudulent accident claims and significantly reduce accident risk by eliminating distracted driving.

Equipment Tracking

Purchase equipment tracking devices to improve inventory management, recover stolen equipment, and improve equipment maintenance.

Use our Section 179 Savings calculator to estimate your savings

What is Section 179

Section 179 is a special provision in the US tax code that allows organizations to depreciate more of their equipment purchases than normal. It is designed to stimulate economic growth by giving organizations the ability to purchase equipment and receive a higher than normal tax deduction in the form of accelerated depreciation. Normally, the tax code allows for equipment to be depreciated over the course of several years, which is typically 20% per year over 5 years for small equipment purchases. However, Section 179 gives you the ability to accelerate the amount of the depreciation within the same year as it is purchased. If you expect an operating profit this year, it might make sense to purchase equipment before the end of the year so you can receive this special tax deduction, thereby reducing the net cost of the equipment. The great thing about this incentive is that it also applies to equipment that is financed or leased. Therefore, you can receive the tax write off this year without even spending the cash on the equipment!

Additional Savings for 2025

The section 179 has increased by $1,280,000 since 2024 and includes a 100% bonus depreciation for 2025! This gives you significant additional savings on your equipment purchases!

Section 179 Website

Additional Section 179 Deduction Calculator

Bonus Depreciation Details

The calculator is for illustrative purposes only. Please consult with a tax professional prior to making decisions that may impact your taxes.